22+ mortgage tax benefits

Web The Illinois Department of Veterans Affairs is committed to serving and assisting those Illinois veterans seeking mortgage assistance as well as resources to assist those. Web Most homeowners can deduct all of their mortgage interest.

Guide To Mortgage Tax Deductions For Your 2019 Taxes Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Web The TCJA limited the deduction to interest on up to 750000 of mortgage debt incurred after December 14 2017 to buy or improve a first or second home.

. Web Advance Child Tax Credit. Web The tax deduction for mortgage interest is one of the most valuable tax breaks for homeowners. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web A Mortgage Tax Credit Certificate MCC is a tax credit issued by the government directly to a homeowner. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

The amount of credit you. So if you have. Web Mortgage Loan Tax Benefits under Income Tax Act January 13 2022 A Loan Against Property is a secured advance amount that users get against their.

Web The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year. It allows them to reduce their tax bill by a specific. Ad See what your estimated monthly payment would be with the VA Loan.

Ad Compare More Than Just Rates. Find A Lender That Offers Great Service. Homeowners can deduct interest expenses on up to 750000 of mortgage debt from their income taxes though when they itemize these deductions.

By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes. Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec. Protects the Lender If the Borrower Defaults.

You may reduce your taxable income by up to 10000 5000 if. Web Lets look at the two main benefits of homeownership before 2017. Compare Loans Calculate Payments - All Online.

Mortgage insurance protects the lender from default because it provides financial protection in case the borrower fails. Web Property tax deduction. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Web In fact the mortgage interest tax deduction primarily benefits taxpayers making more than 200000 according to the Tax Foundation an independent. Mortgage Interest Deduction The mortgage interest deduction allows you to deduct any. But the Tax Cuts and Jobs Act reduced the amount you can.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Ad Compare Home Financing Options Get Quotes. The IRS lets you ease the pain of paying property and other state and local taxes.

Events Archive Page 2 Of 19 Minnesota Mortgage Association

Mortgage Interest Tax Relief Everything You Need To Know Uk Salary Tax Calculator

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

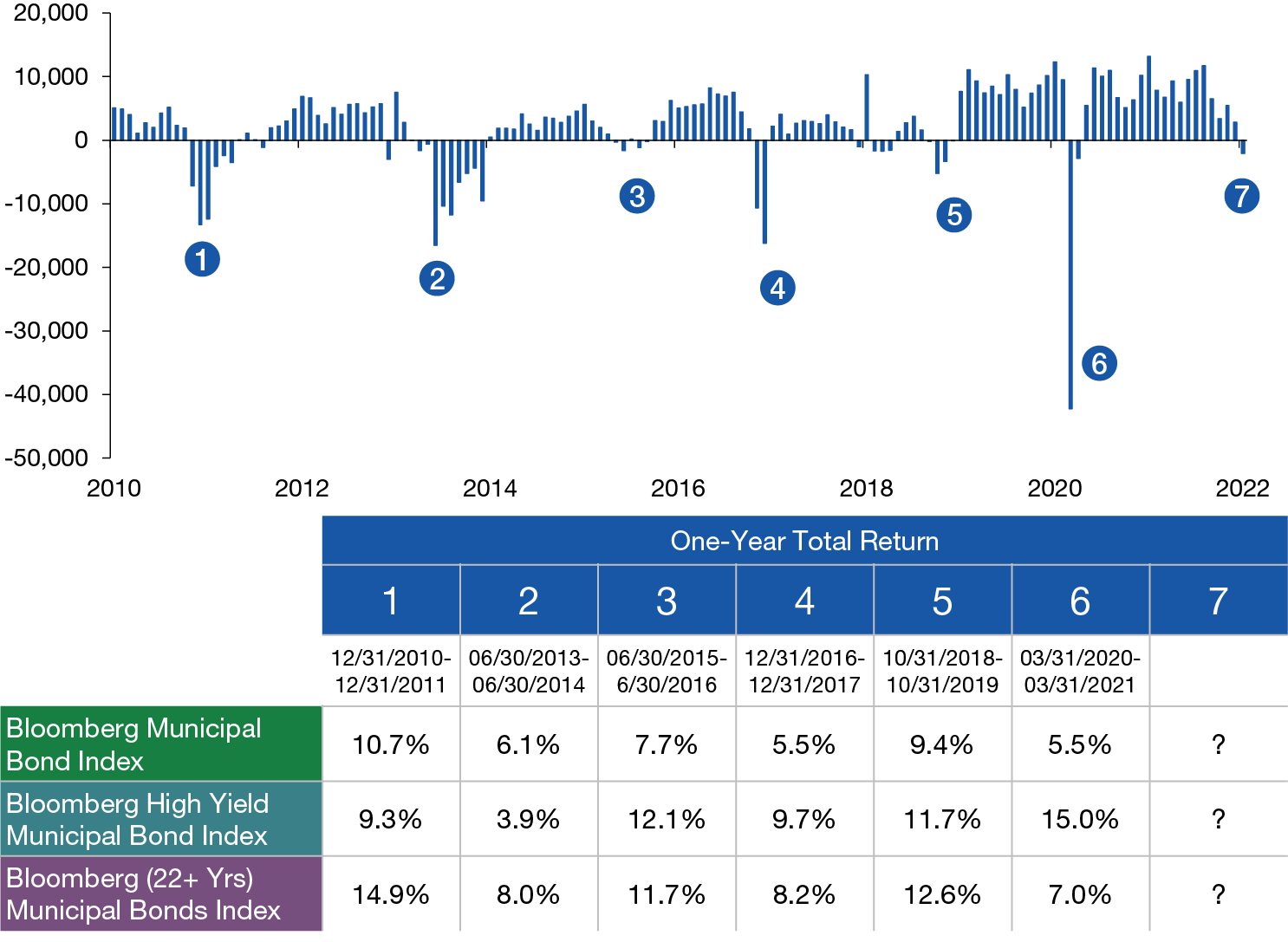

How Bonds Have Fared Since 8 4 20

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Municipal Bonds The Value Of Staying Invested

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

What Tax Breaks Do Homeowners Get In New York

Can I Claim Loan Mortgage Interest As A Tax Reduction Moore

Mortgage Interest Deduction Rules Limits For 2023

What Is Mortgage Interest Deduction Zillow

Pdf A Minimum Income For Healthy Living Mihl Older New Zealanders

The History And Possible Future Of The Mortgage Interest Deduction

The Tax Benefits Of Owning A Home Must Know Deductions And Credits Credible

Faq Are Mortgage Payments Tax Deductible Hypofriend